Neenah Paper announced on October 11th 2017 that it has agreed to buy 100% of the shares of W.A. Sanders Coldenhove B.V. (“Coldenhove Paper”) from the Sanders and Van Vreeswijk families and the management.

Purchase price approx. $45 million and EBITDA approx. $6 million which means a multiple of 7.5x.

The most successful innovation of Coldenhove is digital transfer paper (developed by Coldenhove in 1998). Coldenhove’s Jetcol™ digital sublimation transfer paper is a world wide leading brand and is patented. The company had $45 million sales in 2016.

The transaction is in line with Neenah’s strategy to grow in profitable markets. Sisu supported MidCap Alliance partner Rembrandt M&A as financial adviser to Coldenhove in the transaction by suggesting and tiering its buyer universe.

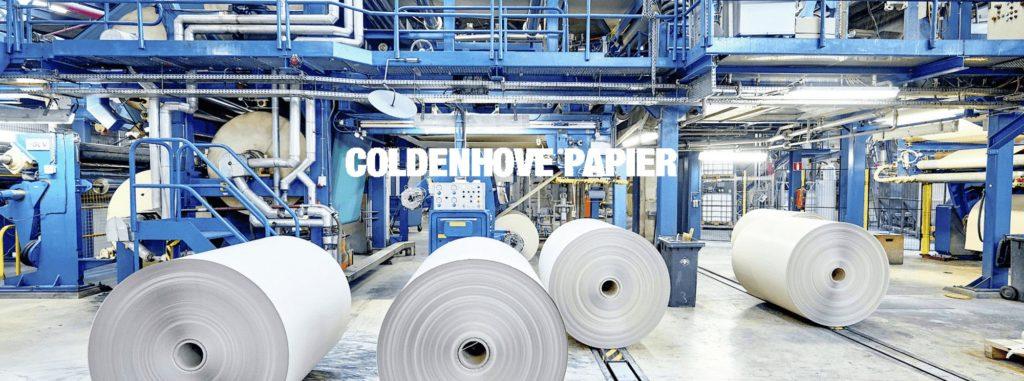

About Coldenhove

Established in 1661, Coldenhove is a well known specialty materials manufacturer based in the Netherlands, with a leading position in digital transfer media and other technical products.

Coldenhove has annual sales of over $45 million with EBITDA of approximately $6 million. The company’s advanced media is a critical component used in dye sublimation, a growing method of digital image transfer.

About Neenah

Neenah is a leading global specialty materials company, focused on premium niche markets that value performance and image. Key products and markets include advanced filtration media, specialized performance substrates used for tapes, labels and other products, and premium printing and packaging papers. The company is headquartered in Alpharetta, Georgia and its products are sold in over 80 countries worldwide from manufacturing operations in the United States, Germany and the United Kingdom. Additional information can be found at the company’s web site, www.neenah.com.